2022-05-07 17:04:27

2022-05-07 17:04:27

Since the beginning of this year, the mother fund has been erupting in the country, and the concept of "urban investment bank" has become increasingly fierce。We will focus on Wuhan, where preferential policies have been frequent in recent years, from the "venture capital cluster" it has created to the two major problems in front of the guide fund, and explore where Wuhan should break the game。

Wuhan's relevant policies, and some areas with tax incentives to attract private funds registered in the practice of taking a different route, such as Optics Valley "ten venture capital" the biggest point is the equity investment institutions "raising investment management back" the whole chain of rewards。

Since the opening of 2022, the Wuhan venture capital market has been particularly lively。

The total size of the former Optical Valley Venture Capital guide fund expanded to 10 billion yuan,After that, Hubei Province integrated and established 50 billion yuan mother fund, and Pacific Insurance Capital 20 billion yuan super insurance mother fund landed;The city of Wuhan has just announced a work plan to accelerate the development of equity investment,That light Valley issued the "Ten venture capital", the maximum reward of capital settlement 20 million,Full pull。

On the one hand, in the past many years, Wuhan has been building a "venture capital cluster" including mother funds, industrial funds, venture capital funds, and angel funds, and capital has helped form a new industrial cluster with remarkable results。On the other hand, the cities in the central region have taken the east wind of venture capital in recent years, Hefei is known as the "strongest venture capital city" because of the precise investment in BOE and NiO Automobile, Changsha with a large number of new consumer IP is the darling of "Generation Z" venture capital, Zhengzhou is the capital of venture capital in Central China recently。A pitched battle is inevitable。

Wuhan, the first to lay out private equity investment and support regional industrial development with the help of financial instruments such as funds, was once overshadowed by several other cities。Wuhan Venture Capital is on the road to a new round of outbreak。

Preferential policies are frequent, and government guidance funds have exploded

In recent years, with the adjustment of economic structure, the central and western regions are fully undertaking the industrial transfer of the eastern regions。At the same time, all localities are also actively introducing preferential policies to attract the entry and landing of venture capital institutions to help the development of local small and medium-sized enterprises。Against this background,The "new force of venture capital" in central and western China, represented by the two Lakes and Sichuan and Chongqing, has accelerated its rise。

Among them, Wuhan belongs to the first echelon of "starting", and has given a lot of support at the policy level。Since last year alone, there have been a number of major policies and programs announced。

Under the continuous policy support, the government-guided fund, as an important financial tool, has also been rapidly developed。Especially since the beginning of this year, the news on the integration of mother funds, expansion and the establishment of industrial funds has come one after another, and people have seen Wuhan's determination in the development of venture capital。

On March 16, the Optical Valley Venture Capital Guide Fund announced its expansion to 10 billion yuan, with the first phase of 2 billion yuan in 2022。

Just a few days later, Wuhan East Lake High-tech Zone proposed to set up a 10 billion yuan laser industry development fund。

At the end of March, another heavy news came out: the Yangtze River Industry Group formally integrated and established a 50 billion yuan mother fund, which was formed by the restructuring and expansion of the 10 billion yuan Yangtze Venture Capital Fund and the 40 billion yuan Yangtze Industrial Investment Fund, becoming the largest mother fund this year。

Coincidentally, since the beginning of this year, various places have launched tens of billions of mother funds, and the concept of "urban investment banks" has become increasingly fierce。In the primary market "capital winter" continues to spread, VC, PE fundraising increasingly difficult at the moment, state-owned capital has gradually come to the center of the stage, become the main force of RMB fund fundraising。

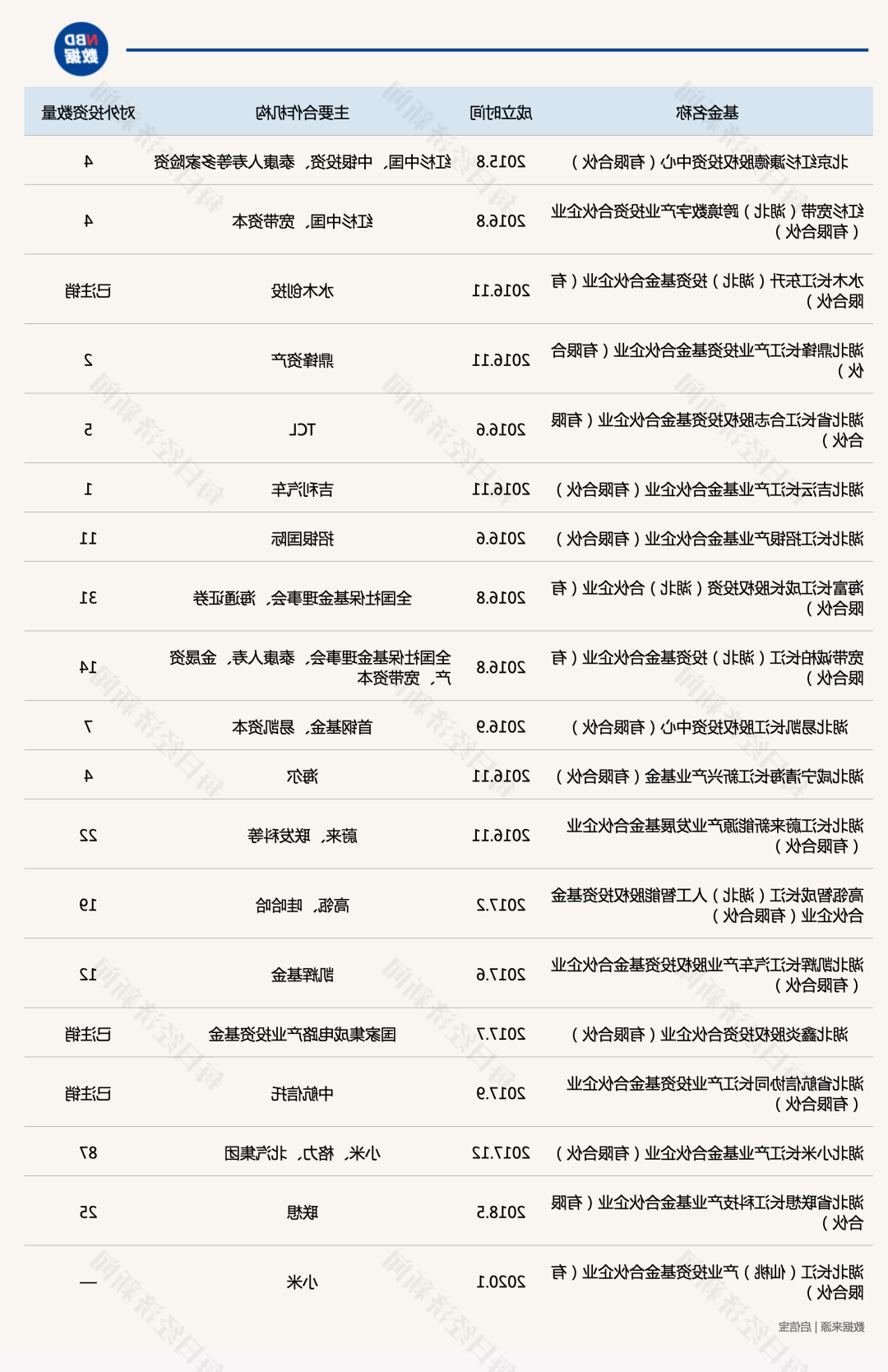

The reason why the government guide fund in Wuhan is effective has a lot to do with its early layout and the formation of a complete matrix。According to the public information, the National Business Daily sorted out the situation of the relatively representative government guidance funds registered in Wuhan, from which we can get a glimpse of the idea。

Give an example,The Hubei provincial venture capital guidance Fund was established and started to operate as early as 2008.Just expanded the Optics Valley venture capital guide fund,Its regulations were issued in 2012;The 40 billion yuan Yangtze River Industrial Investment Fund was also renamed and established on the basis of the original Yangtze River Economic Belt industrial fund,The latter was set up in 2015。From the perspective of provincial, municipal, district and county government guidance funds, the layout is very early。

The provincial + prefecture-level + district-level fund matrix helps to play the role of guiding funds at a more accurate level。This point is also reflected in the type of fund, the number of industrial guidance funds is the largest, and the investment layout can be combined with local advantageous industries。

According to the "Wuhan Equity Investment Market Development White Paper in 2021", as of 2020, the number of guiding funds in Wuhan has reached 31, with a fund size of 104.7 billion yuan, ranking sixth in the country, and the top five are Beijing, Shenzhen, Guangzhou, Shanghai and Xi 'an。

Low return investment, high subsidies, more than 100 billion guide funds "grab money" and "grab people"

Looking at the latest policies of local governments to guide funds in recent years, it can be found that reducing return requirements, improving subsidy standards, and increasing the proportion of investment is a major trend, and Wuhan is no exception。

Taking the return requirement as an example, a Sichuan and Chongqing government guide fund person told every reporter through wechat that in the past, the return multiple required by the government guide fund is usually 1-3 times, and as a whole, twice is the most common return multiple, and the identification of the return is also relatively stricter。However, in the past two years, as the requirements of some government guide funds for the return multiple have been relaxed, the return clause of less than two times is becoming more and more common。

The person in charge of the fund business of Optical Valley Financial Holding said in a telephone interview with every reporter on April 24 that according to the latest policy of Optical Valley Venture Capital Guidance Fund, the maximum amount of investment for a single sub-fund was raised to 100 million yuan, and the return requirement was reduced to 1.5 times, while expanding the scope of recognition of return investment: "The recognition of return investment is very flexible, such as the sub-fund outside the investment enterprises in the zone investment and new enterprises, reporting institutions in the management of other funds investment can be included in the return investment according to the circumstances."。

Another well-known CVC fundraising head also told reporters in a wechat interview in mid-April that his institution had cooperated with a number of local governments to land sub-funds, and the current return requirement in Wuhan was "indeed much lower than when we fell into the fund".。

For another example, in terms of team landing or key person locking, which are required in many cities and regions, the requirements of Optical Valley Venture Capital guide Fund are still relatively broad: "There is no mandatory requirement to set up a team in the local area."。

Not only that, in order to retain outstanding talents in the venture capital industry, Wuhan has set up incentives and subsidies for venture capital institutions and investors at the municipal and district and county levels。

For example, the Wuhan Optic Valley Partner Investment Guidance Fund, established in 2021, clearly links the talent factor directly to the sub-fund's return requirements and profit concession policies, and grants 1 to the sub-fund's investment in talent enterprises in East Lake High-Tech Zone and early-stage talent enterprises, respectively.2倍和1.5x reinvestment identification weight。

The just announced "Ten venture capital" of Optics Valley will also give special rewards to high-end talents, reward general venture capital talents by 6% of the annual salary, and reward 10% of the total income of the employee stock ownership platform for enterprises with the development direction of key industries。

Objectively speaking, the relevant policies of Wuhan are different from the practice of attracting private funds to register and settle in some areas with tax incentives, such as the biggest point of Optics Valley's "Ten venture capital" is the reward of the whole chain of equity investment institutions "offering investment management withdrawal"。However, as the most concerned hot spot in the venture capital industry, the relevant policies of taxation are certainly an inescapable topic。There have been well-known institutions because the investment project is about to be concentrated on the market withdrawal, "the family" moved to another area with preferential tax policies, the importance of which can be seen。

Therefore, whether institutions and investors buy it will take time to test。

Create a "venture capital cluster" to support the differentiated development of industries

On April 27, high-end LED chip custom design and manufacturer "Hua Yin core" announced the completion of B2 round of financing, which is the company after the end of December last year to get another financing;A day later, high incidence of malignant tumor early non-invasive screening products and service providers "Emison" announced the completion of more than 100 million yuan of C round financing。

These two companies are from Optical Valley, and as early as the angel round got the sub-fund investment of Optical Valley Financial Holding Group。At the same time, the industries in which these two companies are located well represent the industrial layout preferences of Optical Valley。

The person in charge of the optical Valley financial holding fund business told the Daily Economic News reporter,At the financial level,Optics Valley Venture Capital Guide Fund is around the industrial structure of high-tech zones in the layout: "For example, optoelectronic information, biomedicine are the main industrial direction of high-tech zones.,So the fund will have a slightly higher ratio,Some seed funds will also be set up to invest;Other directions such as new energy, Internet and other fields,There will also be some layout,But the proportion is relatively low。”

Creating different forms of fund clusters to support the differentiated development of regional industries is a major feature of Wuhan Venture Capital。As the above government guidance fund said, compared with national industrial investment funds, local funds can be combined with regional characteristics, more conducive to the realization of industrial concentration and improve investment efficiency。

In June 2021, Hubei High-quality Development Industry Investment Fund of 15 billion yuan was established, managed by Hongtai Fund, a well-known investment institution in China。Every reporter sent an interview letter to Hongtai Fund in mid-April, and its partner Tang Yingxu said in his reply that the characteristics of venture capital development in Wuhan are very matched with the characteristics of Wuhan's industry。

"The start of Wuhan venture capital industry is from a series of state-funded platforms such as Wuke Investment, Optical Valley Talent Fund, and Optical Valley Venture Capital。The two complement each other to make the overall venture capital atmosphere in Wuhan pragmatic and healthy, and the financing needs of enterprises can be effectively met, and the investment market can avoid facing high valuation bubbles as much as possible, and jointly achieve the goal of promoting enterprise development with financial tools。”

Hubei high-quality development industry fund landed in Wuhan Economic Development Zone。Different from the East Lake High-tech Zone, it is one of the six major domestic automobile bases, and the "Car Valley Capital Island" being built is also the introduction and layout of capital around the automobile industry chain。

Just like Tang Yingxu introduced,In the past year,The fund has invested in Changli New Material, the largest glass manufacturing enterprise in central China, Guodian Hydrogen Energy, which is independently developed by the whole hydrogen fuel cell industry chain, and Uisei Technology, an autonomous driving head enterprise,"In general,We hope to adopt a multi-dimensional and multi-means investment strategy,Achieve the core goal of promoting the development of Wuhan's science and technology industry"。

Another professional investment institution that has set up an industrial fund in Wuhan Economic Development Zone is BOCOM International。In 2020, BOCOM Group, a subsidiary of BOCOM International, and Dongfeng Motor Group initiated the establishment of the Dongfeng BOCOM Yujing Automotive Industry equity investment Fund with an initial scale of 1.6 billion yuan in the economic development Zone to invest in the automotive industry, one of the pillar industries in Wuhan。

Bank of Communications International recently pointed out in a written reply to a reporter interview that the venture capital environment of a region is closely related to industrial development potential, relevant policy support, the number of high-tech enterprises, talent reserves and other aspects。Bocom International said that overall, Wuhan has a good venture capital environment, and the "965" industrial cluster development idea proposed by Wuhan at the end of 2020 needs the support of the venture capital industry, which will also bring a lot of opportunities for the venture capital industry。

Lack of attraction to the head mechanism?Two big problems lie ahead of the guiding fund

Like the government guidance funds of many major cities in China, in terms of the capital that they want to introduce, Wuhan's guidance fund is also targeting the top 30 GP。

The person in charge of the optical Valley financial holding fund business said,After expansion, the Optical Valley Venture Capital guide fund chooses GP,Three aspects will be considered: First,It should be highly compatible with the industrial structure of Wuhan East Lake High-tech Zone,In these industries have relatively deep accumulation and cognition;second,Hope to introduce the national head,Or an organization that focuses on a particular track and has a substantial investment record;third,They also tend to cooperate with industrial capital。

So what institutions have these guiding funds attracted to Wuhan?Let's take some representative sub-funds of the former Industrial Fund of the Yangtze River Economic Belt as an example to look at the cooperation between this fund and other institutions。

From this statistical result alone, it can be found that the industrial fund of the former Yangtze River Economic Belt has introduced a lot of industrial capital and some well-known institutions to Wuhan, and the proportion of the former is significantly higher。

But on the other hand, we should also see that there are a large number of excellent institutions in the PE/VC industry that have not entered the list of cooperation of the fund。Secondly, in addition to individual funds with high investment frequency such as Millet Yangtze River Industry Fund, many sub-funds are not active, and even some have been written off for a short time。In addition, after intensively investing in a series of sub-funds in the early days of its establishment, the original Yangtze River Economic Belt Industrial Fund has almost stopped foreign investment in recent years, and the new ammunition brought by the integration may be able to re-" activate "the mother fund。

In fact, the government will also encounter some very practical problems in the process of funding and landing funds。

The person in charge of the Optical Valley Financial holding fund business admitted to the reporter that it is difficult for the sub-fund to raise funds, and the mother fund is insufficient to contribute to a single sub-fund with a relatively large scale, which is a problem in front of many guiding funds。

"First of all, the proportion of investment in the guide fund is limited, and the rest needs to be raised by the management institutions themselves from the social capital level, which is still difficult for many institutions.。Sometimes because of this problem, our money can not be successfully funded, and it takes more than half a year for a sub-fund to land。Secondly, the size of a single fund of many head institutions is 3 billion to 5 billion yuan, due to the reason of the investment limit, the investment capacity of a single guide fund is less than 20% of the investment requirements, and can only cooperate with other guide funds, and everyone contributes together。This may be a problem that many mother funds will encounter in the process of playing the role of investment promotion。”

It is also because of this that the total size of the Optical Valley Venture Capital Guide Fund will be expanded to 10 billion yuan this year, and through the leverage amplification of the mother fund, it can better meet the financing needs of enterprises in the East Lake High-Tech Zone。

The person in charge also said that in the future, the development direction of the Optical Valley Venture Capital guide fund is to combine the social effects of the guide fund with economic benefits, such as making a more market-oriented mother fund, "or to solve by means of the market, so this way may be the most reasonable."。

"City investment bank" has become a trend, where Wuhan should break the game

In the past, the "you chase me" between the six provincial capitals in central China has always been intense。Now there is another competition: who is the king of the central region of venture capital, venture capital center?

Hefei and Changsha have a lot of successful cases in the field of venture capital, no more details。We can turn our eyes to Zhengzhou: In 2021, Zhengzhou has set up a total of 3 government investment funds at the municipal level, with a total scale of 30.3 billion yuan, participated in 18 sub-funds of various types, with a total scale of 57.3 billion yuan, and invested 161 projects of various types, driving social investment of more than 100 billion yuan。These cities clearly have a deep understanding of the role that mother funds and venture capital funds can play in supporting industrial clusters and high-quality economic development。

Not only that, since the beginning of this year, the mother fund has shown a trend of outbreak in the country。In the equity investment market, it is rare to hear the news of the successful raising of VC or PE funds in the new phase, but the voice of the establishment of tens of billions of funds is a wave。According to the incomplete statistics of every reporter, since the beginning of this year, nearly 20 billion funds have been set up in the country, and the model of "urban investment banks" has become a trend。

In this regard, Pan Xilong, associate professor of the China Financial Research Center of Southwest University of Finance and Economics, said in a written reply to a reporter interview that the province, city and county set up a large number of large funds, the main goal is nothing more than to attract investment, "to introduce the mother, to invest, to promote industrial development".。因此,Judge whether it has played the desired role and achieved the expected effect,It depends on whether it really attracted a large number of high-quality, professional fund teams,Whether the government's guidance fund has been leveraged and enlarged through these teams, and whether it has really invested in good enterprises and good projects,Whether it drives the high-quality development of the local economy。

He admitted that a large number of fund funds are being set up everywhere, which also means that money is becoming less and less of a problem for good GP。"The non-financial competitiveness of local governments, such as financial environment, business environment, legal environment, natural environment, government effectiveness, openness, credibility, etc., may become increasingly important."。

Specific to the frequent actions of Wuhan fund, Tang Yingxu believes that this sends a signal that the management department of Wuhan financial market is gradually familiar with the guidance and influence of the industrial industry through the financial instrument of the fund。This method will effectively leverage the professional ability of market-oriented investment institutions, and will further amplify the efficiency of the use of state-owned funds, which will ultimately be reflected in the precise support of innovative enterprises, and will undoubtedly promote the local entrepreneurial environment to be more perfect。

In the view of BOCOM International, local governments are actively developing the venture capital industry, especially in some coastal cities, the market mechanism is more flexible。In order to attract more venture capital institutions to settle in Wuhan, the government itself should further optimize the venture capital environment from the aspects of supporting policies and supporting investment of mother funds。

The agency also suggested that relevant departments organize and coordinate large local enterprise groups to participate in the establishment of various funds as industrial capital。"The organic combination of industrial capital and financial capital, on the one hand, is conducive to improving the fund's resource mining and risk prevention and control capabilities, on the other hand, is conducive to the transformation and development of traditional industrial groups in the field of innovative technology, and can also better empower invested enterprises.。”